Input tax credit mechanism. The two reduced SST rates are 6 and 5.

The change to the tax system is part of a wave of economic reforms promised by newly-elected Prime Minister Dr Mahathir Mohamad who came to.

. Click on the bolded link to read. Final Malaysia GST03 Submission is 29122018. Estimated Submission andor Processing Time GuidesFAQ.

Implemented in April 2015 the Goods and Services Tax GST is a value added tax in Malaysia. Generally all imported goods into Malaysia are subject to GST. How Does Gst Work Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group Goods And Services Tax Gst In Malaysia 3e Accounting Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog Gst Vs Sst In Malaysia Mypf My.

In May 2018 Malaysias Ministry of Finance announced that Goods and Services Tax GST would be abolished - and replaced by a reintroduced Sales and Services Tax SST at an as-yet unannounced date. Businesses are allowed to claim whatever amount of GST paid on the business inputs by offsetting against the output tax. GST is charged on all taxable supplies of goods and services in Malaysia except those goods and services that are explicitly exempted.

The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity. The existing standard rate for GST effective from 1 April 2015 is 6. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10.

For annual turnover below RM5 million the frequency of filing is quarterly. An assured opportunity to get job at ICICI Bank. For official guide from Customs Malaysia refer to httpwwwcustomsgovmymsDocumentsGSTSubmission20GST.

Melayu Malay 简体中文 Chinese Simplified Monthly GST Filing in Malaysia. Download GST-01 Guidelines here. PERMOHONAN PENDAFTARAN CUKAI BARANG DAN PERKHIDMATAN.

Application For Goods And Services Tax Registration. The Malaysian government replaced GST with SST as of September 1 2018. However certain goods imported by any person or class of persons are given relief from payment of GST upon importation under the Goods and Services Tax Relief Order 2014.

Your entitys tax reference or GST registration number eg. Submit GST DECLARATION BY PERSON OTHER THAN A TAXABLE PERSON SUMMARY Business Registration No. Name of Business Transaction Type TC1234567890.

Businesses have to charge and collect GST on all taxable goods and services supplied to the consumers. For online submission of Form GST-04 can see here. As for the frequency it depends on the annual turnover of the company.

Under the scope of Goods and Services Tax GST in Malaysia supplies fall into 4 categories. Submission GST-03 Return for Final Taxable Period Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period. They are standard rated supplies zero rated supplies exempt supplies and supplies not within the scope of GST.

Commonly Faced Problems by Foreigner When Doing Business in Malaysia. Goods. Submission 5 minutes Processing Your GIRO arrangement will be set up within 3.

More 108 17052019 GST Guide On Tax Invoice Debit Note Credit Note And Retention Payment After 1st September 2018. EVEN FYE Months 1st First Taxable Period 2 month 1st Taxable Period 1st September to 31st October 2018 Two months 2nd Taxable Period 1st November to 31st December 2018 Two months and so on. The GST regime has been in place since April 1 2015.

The documents that is used to submit the GST Returns is called Form 3. Only businesses registered under GST can charge and collect GST. It applies to most goods and services.

Malaysia is the third largest economy in South East Asia and has now become an upper middle income and export-oriented economy. GST is also charged on the importation of goods and services into Malaysia. 200312345A or M90312345A Your Singpass.

A GST registered person has to submit the Form GST-03 return. - Pos Bayaran Kepada JABATAN kaSTAM MALAYSIA PUS-AT PEMPROSESAN GST ARAS 1 BLOK A KOMPLEKS kaSTAM WPKL JALAN SS 63 KELANA JAVA 47300 PETALING JAVA SELANGOR RTNPYM. Previously we discussed What is GST in Malaysia.

This page is also available in. In Malaysia every GST registered person is required to submit the Form GST-03 return to Malaysian Customs either every 1 month or 3 months depending on the annual revenue of all taxable supplies of the GST registered person. Apply for Payment Plan Re-activate your previous GIRO arrangement and edit your payment plan for your GST.

2021 ITRF Submission Dateline. Every GST registered person is obliged to file GST every month or every 3 months depending on the annual revenue of all taxable supplies of the registered person. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Real Property Gains Tax RPGT.

Documents And Procedures For Exporters Under Gst

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

Mortgage Refinance Malaysia Instant Loans Mortgage Loans Cash Advance Loans

Michael Koes Bag Michael Kors Bag Black Michael Kors Bag Michael Kors Black

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gst Filing Course In Uttam Nagar Goods And Services Goods And Service Tax Hotel Management

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

Filing Of Gst Return Video Guide Youtube

Introducing Our Latest Enhancements To The Singapore Gst F5 Return Experience Xero Blog

Malaysia Accounting Software Best Accounting Software Accounting Software Accounting

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

Filing Of Gst Return Video Guide Youtube

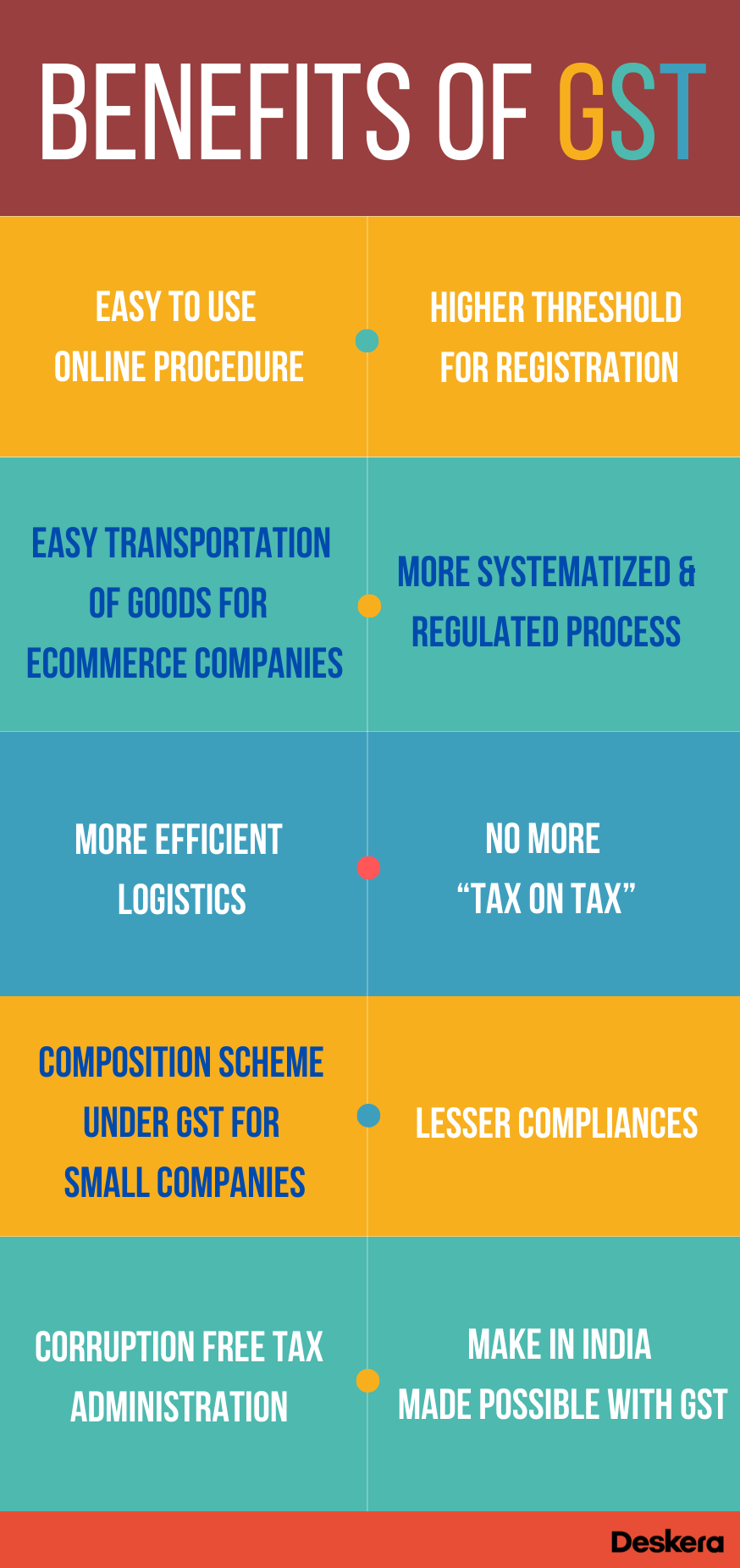

Benefits Of Gst For Small Business And Startups In India Ebizfiling

- four seasons hotel kl

- bayang manusia hitam putih

- tempat menarik di kelantan

- jenis jenis pokok hiasan daun kecil

- gambar semut kartun

- gigi putih dan cantik

- undefined

- gst submission malaysia

- malaysia male names

- challenges of islamic finance in malaysia

- puting botol susu

- minyak hitam grand livina

- sinopsis jodoh jodoh annisa

- kapsul daun sirsak rizhaza shoppe

- packaging kek batik

- surat al fatihah arab saja

- kerja kursus sejarah tingkatan 1 2018

- gambar hitam putih minum air

- borang e vendor 1gfmas

- punca darah haid hitam